What is a Mutual Fund?

A mutual fund is a professionally-managed trust that pools the savings of many investors and invests them in securities like stocks, bonds, short-term money market instruments and commodities such as precious metals. Investors in a mutual fund have a common financial goal and their money is invested in different asset classes in accordance with the fund’s investment objective. Investments in mutual funds entail comparatively small amounts, giving retail investors the advantage of having finance professionals control their money even if it is a few thousand rupees.

Mutual funds are pooled investment vehicles actively managed either by professional fund managers or passively tracked by an index or industry. The funds are generally well diversified to offset potential losses. They offer an attractive way for savings to be managed in a passive manner without paying high fees or requiring constant attention from individual investors. Mutual funds present an option for investors who lack the time or knowledge to make traditional and complex investment decisions. By putting your money in a mutual fund, you permit the portfolio manager to make those essential decisions for you.

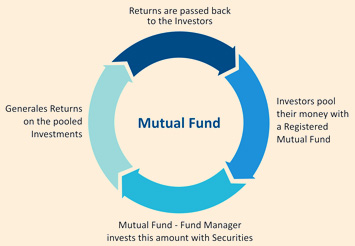

How does a mutual fund operate?

A mutual fund company collects money from several investors, and invests it in various options like stocks, bonds, etc. This fund is managed by professionals who understand the market well, and try to accomplish growth by making strategic investments. Investors get units of the mutual fund according to the amount they have invested. The Asset Management Company is responsible for managing the investments for the various schemes operated by the mutual fund. It also undertakes activities such like advisory services, financial consulting, customer services, accounting, marketing and sales functions for the schemes of the mutual fund.

What are the different types of mutual fund schemes?

Based on the maturity period Type of Fund Equity or Growth Fund Fixed Income Fund Money Market Fund Balanced Fund Sector-specific Fund Index Fund Fund of funds

Open-ended Fund

An open-ended fund is a fund that is available for subscription and can be redeemed on a continuous basis. It is available for subscription throughout the year and investors can buy and sell units at NAV related prices. These funds do not have a fixed maturity date. The key feature of an open-ended fund is liquidity.

Close-ended Fund

A close-ended fund is a fund that has a defined maturity period, e.g. 3-6 years. These funds are open for subscription for a specified period at the time of initial launch. These funds are listed on a recognized stock exchange.

Interval Funds

Interval funds combine the features of open-ended and close-ended funds. These funds may trade on stock exchanges and are open for sale or redemption at predetermined intervals on the prevailing NAV.

Based on investment objectives

Equity/Growth Funds

Equity/Growth funds invest a major part of its corpus in stocks and the investment objective of these funds is long-term capital growth. When you buy shares of an equity mutual fund, you effectively become a part owner of each of the securities in your fund’s portfolio. Equity funds invest minimum 65% of its corpus in equity and equity related securities. These funds may invest in a wide range of industries or focus on one or more industry sectors. These types of funds are suitable for investors with a long-term outlook and higher risk appetite.

Debt/Income Funds

Debt/ Income funds generally invest in securities such as bonds, corporate debentures, government securities (gilts) and money market instruments. These funds invest minimum 65% of its corpus in fixed income securities. By investing in debt instruments, these funds provide low risk and stable income to investors with preservation of capital. These funds tend to be less volatile than equity funds and produce regular income. These funds are suitable for investors whose main objective is safety of capital with moderate growth.

Balanced Funds

Balanced funds invest in both equities and fixed income instruments in line with the pre-determined investment objective of the scheme. These funds provide both stability of returns and capital appreciation to investors. These funds with equal allocation to equities and fixed income securities are ideal for investors looking for a combination of income and moderate growth. They generally have an investment pattern of investing around 60% in Equity and 40% in Debt instruments.

Money Market/ Liquid Funds

Money market/ Liquid funds invest in safer short-term instruments such as Treasury Bills, Certificates of Deposit and Commercial Paper for a period of less than 91 days. The aim of Money Market /Liquid Funds is to provide easy liquidity, preservation of capital and moderate income. These funds are ideal for corporate and individual investors looking for moderate returns on their surplus funds.

Gilt Funds

Gilt funds invest exclusively in government securities. Although these funds carry no credit risk, they are associated with interest rate risk. These funds are safer as they invest in government securities.

Some of the common types of mutual funds and what they typically invest in:

Typical Investment

Equities like stocks

Fixed income securities like government and corporate bonds

Short-term fixed income securities like treasury bills

A mix of equities and fixed income securities

Sectors like IT, Pharma, Auto etc.

Equities or Fixed income securities chosen to replicate a specific Index for example S&P CNX Nifty

Other mutual funds

Other Schemes

Tax-Saving (Equity linked Savings Schemes) Funds

Tax-saving schemes offer tax rebates to investors under specific provisions of the Income Tax Act, 1961. These are growth-oriented schemes and invest primarily in equities. Like an equity scheme, they largely suit investors having a higher risk appetite and aim to generate capital appreciation over medium to long term.

Index Funds

Index schemes replicate the performance of a particular index such as the BSE Sensex or the S&P CNX Nifty. The portfolio of these schemes consist of only those stocks that represent the index and the weightage assigned to each stock is aligned to the stock’s weightage in the index. Hence, the returns from these funds are more or less similar to those generated by the Index.

Sector-specific Funds

Sector-specific funds invest in the securities of only those sectors or industries as specified in the Scheme Information Document. The returns in these funds are dependent on the performance of the respective sector/industries for example FMCG, Pharma, IT, etc. The funds enable investors to diversify holdings among many companies within an industry. Sector funds are riskier as their performance is dependent on particular sectors although this also results in higher returns generated by these funds.

What are the risks involved in investing in mutual funds?

Mutual funds invest in different securities like stocks or fixed income securities, depending upon the fund’s objectives. As a result, different schemes have different risks depending on the underlying portfolio. The value of an investment may decline over a period of time because of economic alterations or other events that affect the overall market. Also, the government may come up with new regulations, which may affect a particular industry or class of industries. All these factors influence the performance of Mutual Funds.

Risk and Reward:

Lack of Control:

How is a mutual fund set up?

A mutual fund is set up in the form of a trust that has a Sponsor, Trustees, Asset Management Company (AMC). The trust is established by a sponsor(s) who is like a promoter of a company and the said Trust is registered with Securities and Exchange Board of India (SEBI) as a Mutual Fund. The Trustees of the mutual fund hold its property for the benefit of unit holders. An Asset Management Company (AMC) approved by SEBI manages the fund by making investments in various types of securities.

The trustees are vested with the power of superintendence and direction over the AMC. They monitor the performance and compliance of SEBI regulations by the mutual fund. The trustees are vested with the general power of superintendence and direction over AMC. They manage the performance and compliance of SEBI Regulations by the mutual fund..

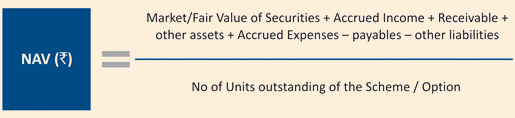

What is Net Asset Value?

Net Asset Value (NAV) is the total asset value (net of expenses) per unit of the fund and is calculated by the AMC at the end of every business day. In order to calculate the NAV of a mutual fund, you need to take the current market value of the fund’s assets minus the liabilities, if any and divide it by the number of shares outstanding. NAV is calculated as follows:

For example, if the market value of securities of a Mutual Fund scheme is 500 lakh and the Mutual Fund has issued 10 lakh units of 10 each to investors, then the NAV per unit of the fund is 50.

What are the benefits of investing in a mutual fund?

Benefits of investing in mutual funds:

Professional Management

When you invest in a mutual fund, your money is managed by finance professionals. Investors who do not have the time or skill to manage their own portfolio can invest in mutual funds. By investing in mutual funds, you can gain the services of professional fund managers, which would otherwise be costly for an individual investor.

Diversification

Mutual funds provide the benefit of diversification across different sectors and companies. Mutual funds widen investments across various industries and asset classes. Thus, by investing in a mutual fund, you can gain from the benefits of diversification and asset allocation, without investing a large amount of money that would be required to build an individual portfolio.

Liquidity

Mutual funds are usually very liquid investments. Unless they have a pre-specified lock-in period, your money is available to you anytime you want subject to exit load, if any. Normally funds take a couple of days for returning your money to you. Since they are well integrated with the banking system, most funds can transfer the money directly to your bank account.

Flexibility

Investors can benefit from the convenience and flexibility offered by mutual funds to invest in a wide range of schemes. The option of systematic (at regular intervals) investment and withdrawal is also offered to investors in most open-ended schemes. Depending on one’s inclinations and convenience one can invest or withdraw funds.

Low transaction cost

Due to economies of scale, mutual funds pay lower transaction costs. The benefits are passed on to mutual fund investors, which may not be enjoyed by an individual who enters the market directly.

Transparency

Funds provide investors with updated information pertaining to the markets and schemes through factsheets, offer documents, annual reports etc.

Well regulated

Mutual funds in India are regulated and monitored by the Securities and Exchange Board of India (SEBI), which endeavors to protect the interests of investors. All funds are registered with SEBI and complete transparency is enforced. Mutual funds are required to provide investors with standard information about their investments, in addition to other disclosures like specific investments made by the scheme and the quantity of investment in each asset class.

Tools to Invest in MF

Systematic Investment Plan (SIP)

Systematic Investment Plan (SIP) is an option where you invest a fixed amount in a mutual fund scheme at regular intervals. For example, you can invest 1,000 in a mutual fund every month. It is a disciplined investment plan and helps reduce propensity to market fluctuations. It is a convenient tool that helps you preserve capital and also render significant wealth creation in the long-run. Starting Age 25 30 35 40 Thus, the power of compounding can have a considerable impact on your wealth accumulation, particularly if the investment is for a long period of time.

SIP investments can help you reach your financial goals by taking advantage of rupee cost averaging, and growing your investments with compounded benefits.

SIP has several advantages over one-time investment. Some of the advantages are mentioned below:

o Disciplined approach to investments

o Flexibility to invest small amounts every month

o Benefit from the power of 2 powerful investment strategies

o Rupee cost averaging – helps counter volatility

o Power of compounding – small investments create a big kitty over time

o Convenient and hassle-free mode of investment

o No need to time the market

Rupee Cost Averaging.

Rupee Cost Averaging is an effective mechanism which helps in eliminating the need to time the market. Under this method, one need not be concerned about when and how much to invest. A fixed sum of money can be invested regularly and over time it averages out the costs. Say, you invest 1,000 a month, and, the price of the selected mutual fund scheme unit is 10 in the first month, you will get 100 units.

In the next month, if the unit price falls to 9, you are allotted 111 units. In the third month, if the price drops further to 8, it can get you 125 units. Thus, by investing 3,000 over three months, you will get 336 units.

On the other hand, had you invested the entire amount in the first month itself, you would have gained just 300 units. In case of SIPs, the average unit cost is about 8.9 as compared to 10 in case of lump sum investments. Thus, SIPs help lower the average unit cost and can buy you more units.

Power of Compounding

You can gain from compounding by reinvesting the money you earn from your investments to earn even more. The earlier you start, the longer your money has the opportunity to compound and enhance your corpus helping you achieve your financial goals.

Below is an example for a SIP of 1,000 invested per month @8% till the age of 60.

Total Amount Saved (Rs.)

Value at the Age of 60 (Rs.)

4,20,000

23,09,175

3,60,000

15,00,295

3,00,000

9,57,367

2,40,000

5,92,947

Convenience of Investment

Register for SIP by signing up the required forms of periodic investments (monthly/quarterly) based on your suitability. Your account will be automatically debited on the requested date to purchase the units of the required fund.

SIP is a simple, convenient and affordable way to invest for your future. With as little as 1,00 every month, it’s an effective method to invest in the growth potential of Mutual Funds.

Systematic Withdrawal Plan (SWP)

An SWP allows an investor to withdraw a designated sum of money and units from the fund account at pre-defined regular intervals. It allows investors a certain level of independence from market instability and helps in avoiding market timing. The investor can reinvest the redeemed cash in another portfolio or use it as a source of regular income.

Advantages

Regular Income - SWP helps in creating a regular flow of money from investments on a periodic basis i.e. on a monthly or quarterly basis.

Tax Benefit - Instead of selling all the units at once, spanning the income across multiple intervals can lower the total tax. It is a tax efficient way of receiving regular income.

Avoid market fluctuations - It saves an investor from market fluctuations, as regular withdrawal averages out return value.

How does an SWP work?

An SWP allows you to withdraw a fixed sum of money every month or quarter depending on the option chosen and instructions given by you.

Let's say Ashish has 10,000 units in a mutual fund scheme on 1-Dec-11. He intends to withdraw 6,000 every month through SWP.

Date

Opening Balance (Units)

NAV

Units Redeemed

Closing Balance

1-Dec-11

10000

20

300 (6000/20)

9700

1-Jan-12

9700

18

333.33 (6000/18)

9366.67

1-Feb-12

9366.67

22

272.73 (6000/22)

9093.94

In this manner, units from mutual fund holdings will be redeemed in a systematic way to provide the investor with regular income.

Types of SWP

SWP is usually available in two options:

Fixed Withdrawal: In a fixed withdrawal option, the investor specifies the amount he wants to withdraw from his investment on a monthly/quarterly basis.

Appreciation Withdrawal: In an appreciation withdrawal option, the investor withdraws only the appreciated amount on a monthly/quarterly basis.

An SWP can help investors who require liquidity as it permits them to access their money precisely when they need it to meet their needs.

Systematic Transfer Plan (STP)

An STP is a plan that allows investors to give consent to a mutual fund to periodically transfer a certain amount / switch (redeem) certain units from one scheme and invest in another scheme of the same mutual fund house. Thus at regular intervals an amount/number of units you choose is transferred from one mutual fund scheme to another of your choice. This facility thus helps in deploying funds at regular intervals.

Advantages

Consistent Returns – Through STP, you can transfer your money to a target equity fund while you are invested in a debt or liquid fund. Therefore, you will get the returns of the equity fund you are transferring into and at the same time remain protected as a part of your investment remains in debt.

Averaging of Cost – Like SIP, in STP too, a fixed amount of money is invested in the target fund at regular intervals. Since it is similar to SIP, STP assists in averaging out the cost of investors by purchasing more units at a lower NAV and vice versa.

Rebalancing Portfolio – STP facilitates in rebalancing the portfolio by allotting investments from debt to equity or vice versa. If your investment in debt increases money can be reallocated to equity funds through an STP and if your investment in equity goes up money can be switched from an equity to a debt fund.

How does a STP work?

The investor needs to select a fund from which the transfer should take place and a fund to which the transfer is taking place. Transfers can be made daily, weekly, monthly or quarterly depending upon the STP chosen and the options available with the AMC.

If an investor chooses to transfer from a liquid fund to an equity fund, the lump sum is invested in a liquid or a floating short-term plan and is transferred at regular intervals to a specified equity fund. For example, if one has 50,000 to invest in equities; he can put the entire amount in a liquid plan and go for a monthly SIP of 5,000 in an equity plan through an STP.

STPs can carry Exit Loads as per the respective schemes of the AMC.

Types of STP

A Systematic Transfer Plan is of three types; Fixed STP, Capital Appreciation STP and Flexi STP.

Fixed STP – In Fixed STP, the investor takes out a fixed sum of money from one investment to another.

Capital Appreciation STP – In Capital Appreciation STP, the investor takes the profit part out of one investment and invests in the other.

Flexi STP – In Flexi STP, the investor has a choice to transfer a variable amount. The fixed amount will be the minimum amount and the variable amount depends upon the volatility in the market.

Thus, STP is particularly suitable to investors who have lump sum money and wish to invest in equity funds but are wary of timing the market. They can then choose to park the lump sum money in a liquid or debt fund and use the STP option to systematically transfer a fixed amount of money at regular intervals into the target equity fund.

Power of Triggers

Trigger facility is an additional, optional feature provided in mutual fund schemes, which enables investors to book profit automatically at a pre-defined time or value. In another words, the fund declares a dividend, redeems and/or switches the units automatically on behalf of the investor on the date of the event.

Principal Mutual Fund has introduced the option of Triggers in its funds. You can specify a specific event, which may be related to time or value, in advance and when this event takes place the trigger is activated. Thus, this facility enables you to keep track of your investments without having to put in time and effort to track portfolio movements on a regular basis. It also helps you maintain a disciplined investment approach that ensures that you meet your investment goals. Triggers are of three types –time-based, value-based and event-based.

Time-based triggers

Time-based triggers are activated on a particular date that you have specified. For example, if you wish to gift some units to your mother on her birthday, a trigger can be set for that date.

Value based triggers

These triggers are based on the change in value of your investments. For example, you need 7.5 lakh for meeting the expenses of son's higher education after 5 years and you have invested 5 lakh in an equity scheme for this. If you set a trigger for change in investment value by at least 50%, the money is shifted to a low risk scheme as soon the value reaches that figure. In this way, the dream of your son's higher education will not go sour even if the market turns bearish.

Value based triggers

You can also set triggers based on the occurrence of a particular external event that affects the value. For example, you want to set the Sensex value of 20,000 as a trigger. If the Sensex is less than 20,000 on the date of allotment, the trigger would be activated when the Sensex closes above 20,000. However, if the Sensex is more than 20,000 on the date of allotment, the trigger would be activated when the Sensex closes below 20,000.

FMP

Particulars Amount Invested Rate of Return Projected Maturity Value () Gross Dividend/Interest () Dividend Distribution Tax / Short term Capital Gains Tax Rate % Tax () Net Dividend / Interest () Post Tax Value () Post Tax Returns Note:-What are FMPs?

What are the benefits of FMPs?

Better Returns - FMPs offer better post-tax returns than FDs as well as liquid and ultra short-term debt funds.

Less Exposure to Interest Rate Risk - As the securities are held till maturity, FMPs are not affected by interest rate volatility.

Tax Benefit - FMPs score over fixed deposits because of their tax effectiveness both in the short-term and long-term.

Lower Cost - Since these instruments are held till maturity, there is a cost saving with respect to buying and selling of instruments.

Double Indexation Benefit - Indexation helps to lower capital gains and thus lower the tax. Double indexation allows an investor to take advantage of indexing his investment to inflation for 2 years while remaining invested for a period of slightly more than a year.

What are the benefits of FMPs?

A portfolio of FMPs consists of various fixed income instruments with matching maturities. On the basis of the tenure of the FMP, a fund manager invests in instruments in such a way, that all of them mature around the same time. During the tenure of the plan, all the units of the plan are held until they mature on a specified date. Thus, investors get an indicative rate of return of the plan.

What are the benefits of FMPs?

o Investors looking at stable returns over the medium-term

o Investors who are not pleased with returns from traditional fixed income avenues like Bank deposits, Bonds etc.

o Investors who want to invest money for a fixed tenure to meet certain financial goals in the future

o Investors with a conservative and risk averse profile

o Retired persons, instead of making random withdrawals from their savings, can invest to have a flexible and regular income

What are the benefits of FMPs?

FMPs usually invest in certificates of deposits (CDs), commercial papers (CPs), money market instruments, highly rated securities (like ‘AAA’ rated corporate bonds) over a defined investment tenure and sometimes even in bank fixed deposits.

What are the benefits of FMPs?

Returns - FMPs are the equivalent of a fixed deposit (FD) in a bank. While, the maturity amount of a fixed deposit in a bank is guaranteed, the maturity amount of an FMP is not guaranteed.

Duration of Investment – FMPs invest as per the tenure of the Scheme i.e ranging from 1 month to 3 years. FDs on the other hand have an investment horizon of 15 days to 10 years.

Taxation - In FDs, the interest income is added to the investor’s income and is taxable at the applicable tax slab. If you invest in the growth option of an FMP for less than a year, the gains are added to the investor's income and taxed at the investor's slab rate. If you invest in the growth option of an FMP for over a year, you pay either 10% capital gains tax without indexation or 20% with indexation.

Example – The following comparative table shows the returns where an Individual investor has invested 10,000 in a Fixed Deposit and a Fixed Maturity Plan for six months in the dividend option.

FMP

FD

10,000

10,000

10

10

10,493

10,493

493

493

14.1625

33.99

61

168

432

326

10,432

10,326

8.76%

6.60%

o The investor in this example falls in the highest tax bracket.

o The 10 % return used in the example for FMP is for illustrative purposes only and not assured and the actual returns may go up or down depending on the market conditions. The Fixed Deposit rate is also for illustrative purposes only.

In case of FMPs; all accretions are assumed paid on maturity.

Tax-saving Benefits of Mutual Fund Investments

Tax

Mutual funds can be tax-efficient investment avenues that can help reduce your tax burden and at the same time increase your wealth.

ELSS – An Ideal Tax-saving Instrument – Equity Linked Savings Schemes (ELSS) offers an easy option to obtain tax benefits and an opportunity to harness the potential upside of investing in the equity market.

What are ELSS Funds?

Offer tax deduction of up to 1.50 lakh under Section 80C of the Income Tax Act, 1961.

Provide double benefit of tax saving and capital gains.

Tax-saving Benefit of ELSS Funds

Lower lock-in period - In comparison to traditional investment avenues like PPF, NSC under section 80C of the Income tax Act, ELSS funds have the shortest lock in period of 3 years.

Tax-free dividends/Capital gains - Dividends declared under the ELSS scheme during the investment period are tax-free. The profits on the sale of ELSS units are treated as long-term capital gains, and are not subject to tax.

Higher return potential - ELSS funds invest a large part of the fund in equity, which despite short-term volatility has the potential to build wealth over the long term.

Who should invest in ELSS Funds?

o Investors looking for wealth creation over the long term.

o Investors looking for tax deductions under Section 80C.

o Investors having a time horizon of 3 years or more.

How to start an ELSS account?

There are two ways to invest in ELSS Funds:

o Invest a fixed amount every month through a Systematic Investment Plan (SIP) in ELSS and ease the burden of large investments towards the end of the financial year.

o Invest a lump sum amount at any point of time.

Why SIP is the best method for ELSS?

One of the best ways to invest is to save and invest on a regular basis. SIP is an investment method in which an investor invests small amounts in mutual funds at regular intervals.

In addition, SIP helps an investor take benefit of the volatility in the stock markets by rupee cost averaging and helps garner the advantage of compounding. Investment in an ELSS through SIP provides an investor the best combination of tax savings and capital appreciation. The minimum investment in an ELSS through the SIP route can be as low as 500.

The lower lock-in period of 3 years in comparison to other tax savings instruments and the potential to take full advantage of growth through equities make ELSS funds a preferred investment option.